UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under Rule 14a-12 | |||

| NISOURCE INC. | ||||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid: | |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

NiSource Inc.

801 E. 86th Avenue — Merrillville, IN 46410 — (877) 647-5990

NOTICE OF ANNUAL MEETING

April 12, 20134, 2014

To the Holders of Common Stock of NiSource Inc.:

The annual meeting of the stockholders (the “Annual Meeting”) of NiSource Inc. (the “Company”) will be held at the InterContinentalCrowne Plaza Chicago O’Hare, 5300 N.5440 North River Road, Rosemont, IL 60018 on Tuesday, May 14, 2013,13, 2014, at 10:00 a.m., local time, for the following purposes:

| (1) | To elect eleven directors to hold office until the next annual stockholders’ meeting and until their respective successors have been elected or appointed; |

| (2) | To consider advisory approval of executive compensation; |

| (3) | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accountants for the year |

| (4) | To consider a stockholder proposal regarding |

All persons who were stockholders of record at the close of business on March 19, 201318, 2014 will be entitled to vote at the Annual Meeting.

Please act promptly to vote your shares with respect to the proposals described above. You may vote your shares by marking, signing, dating and mailing the enclosed proxy card. You may also vote by telephone or through the Internet by following the instructions set forth on the proxy card. If you attend the Annual Meeting, you may be able to vote your shares in person, even if you have previously submitted a proxy. See the section “Voting in Person” for specific instructions on voting your shares.

If you plan to attend the Annual Meeting, please so indicate in the space provided on the proxy card or respond when prompted on the telephone or through the Internet.

PLEASE VOTE YOUR SHARES BY TELEPHONE, THROUGH THE INTERNET OR BY PROMPTLY

MARKING, DATING, SIGNING AND RETURNING THE ENCLOSED PROXY CARD.

Robert E. Smith

Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials

For the Annual Meeting of Stockholders to be Held on May 14, 201313, 2014

The Proxy Statement and 20122013 Annual Report to Stockholders

are Available athttp://ir.nisource.com/annuals.cfm

| 1 | ||||

| 1 | ||||

| 1 | ||||

Discretionary Voting by Brokers, Banks and Other Stockholders of Record | 1 | |||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 9 | ||||

| 9 | ||||

Policies and Procedures with Respect to Transactions with Related Persons | 9 | |||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 14 | ||||

Security Ownership of Certain Beneficial Owners and Management | ||||

| 19 | ||||

| 20 | ||||

| ||||

| ||||

| ||||

| 46 | ||||

Proposal 3: Ratification of Independent Registered Public Accountants | 47 | |||

| 48 | ||||

| 48 | ||||

Proposal 4: Stockholder Proposal Regarding Reports on Political Contributions | 49 | |||

Stockholder Proposals and Nominations for | ||||

The accompanying proxy is solicited on behalf of the Board of Directors of NiSource Inc. (the “Board”). for the 2014 annual meeting of the stockholders (the “Annual Meeting”) to be held at the Crowne Plaza Chicago O’Hare, 5440 North River Road, Rosemont, IL 60018 on Tuesday, May 13, 2014 at 10:00 a.m., local time. The common stock, $.01 par value per share, of the Company represented by the proxy will be voted as directed. If you return a signed proxy card without indicating how you want to vote your shares, the shares represented by the accompanying proxy will be voted as recommended by the Board “FOR” all of the nominees for director; “FOR” advisory approval of the compensation of the Company’s Named Executive Officers; “FOR” the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accountants for 2013; “FOR” advisory approval of the compensation of the Company’s Named Executive Officers;2014; and “AGAINST” the stockholder proposal regarding action by written consent and “AGAINST” the stockholder proposal to establish a policy to end benchmarking CEO compensation.reports on political contributions.

This Proxy Statement and the accompanying proxy card are first being sent to stockholders on April 12, 2013.4, 2014. The Company will bear the expense of this mail solicitation which may be supplemented by telephone, facsimile, e-mail and personal solicitation by officers, employees, and our agents. To aid in the solicitation of proxies, we have retained Phoenix Advisory Partners for a fee of approximately $9,500, plus reimbursement of expenses. We will also request brokerage houses and other nominees and fiduciaries to forward proxy materials, at our expense, to the beneficial owners of stock held on the record date.

We use the terms “NiSource,” the “Company,” “we,” “our” and “us” in this proxy statement to refer to NiSource Inc.

Holders of shares of common stock as of the close of business on March 19, 201318, 2014 are entitled to notice of and to vote at the Annual Meeting. As of March 19, 2013, 311,794,90118, 2014, 314,758,575 shares of common stock were issued and outstanding. Each share of common stock outstanding on that date is entitled to one vote on each matter presented at the Annual Meeting.

If you are a “stockholder of record” (that is, if your shares of common stock are registered directly in your name on the Company’s records), you may vote your shares by proxy using any of the following methods:

Telephoning the toll-free number listed on the proxy card;

Using the Internet sitewebsite listed on the proxy card; or

Marking, dating, signing and returning the enclosed proxy card.

All votes must be received by the proxy tabulator by 11:59 p.m. Eastern Time on May 13, 2013.12, 2014.

If your shares are held in a brokerage account or by a bank or other stockholder of record (herein referred to as a “Broker”), you are considered a “beneficial owner” of shares held in “street name.” As a beneficial owner, you will receive proxy materials and voting instructions from the stockholder of record that holds your shares. You must follow the voting instructions in order to have your shares of common stock voted.

Discretionary Voting by Brokers, Banks and Other Stockholders of Record

If your shares are held in street name and you do not provide the Broker with instructions as to how to vote such shares, your Broker will only be able to vote your shares at theirits discretion on certain “routine” matters as permitted by New York Stock Exchange (“NYSE”) rules. At this meeting, Brokers will have discretionary authority to vote your shares only with regard to the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accountants for 2013.2014. We do not believe that Brokers will have discretionary authority to vote your shares with respect to the election of directors, the advisory approval of executive compensation or the stockholder proposals on action by written consent or a policy to end benchmarking CEO compensation.proposal. Therefore, it is important that you instruct your Broker or other nominee how to vote your shares.

If you hold your shares in the Company’s 401(k) Plan (“401(k) Plan”) administered by Fidelity Management Trust Company (“Fidelity”), you should instruct Fidelity how to vote your shares by one of the methods discussed in this Proxy Statement. If you do not instruct the 401(k) Plan how to vote your shares by completing

and returning the proxy card or by using the telephone or Internet, or if you sign the proxy card with no further instructions as to how to vote your shares, the 401(k) Plan provides for Fidelity to vote your shares in the same proportion as the shares for which it receives instructions from all other participants, to the extent permitted under applicable law.

You also may come to the Annual Meeting and vote your shares in person by obtaining and submitting a ballot that will be provided at the meeting. However, if your shares are held in street name by a Broker, then, in order to be able to vote at the meeting, you must obtain an executed proxy from the Broker, indicating that you were the beneficial owner of the shares on March 19, 2013,18, 2014, the record date for voting, and that the Broker is giving you the proxy to vote the shares.

If your shares are held in the 401(k) Plan, you will not be able to vote your shares at the meeting. In order to vote your shares you must provide instructions to Fidelity either by returning your proxy card or by voting via the telephone or internet no later than 11:59 p.m. Eastern Time on May 13, 2013.12, 2014.

Votes cast in person or represented by proxy at the meeting will be tabulated by the inspectors of election.

If you plan to attend the Annual Meeting, please so indicate when you vote, so that we may send you an admission ticket and make the necessary arrangements. Stockholders who plan to attend the meeting must present picture identification along with an admission ticket or evidence of beneficial ownership.

You may revoke your proxy at any time before a vote is taken or the authority granted is otherwise exercised. To revoke a proxy, you may send to the Company’s Corporate Secretary a letter indicating that you want to revoke your proxy or you can supersede your initial proxy by submitting a duly executed proxy bearing a later date, voting by telephone or through the Internet on a later date, or attending the meeting and voting in person. Attending the Annual Meeting will not in and of itself revoke a proxy.

A quorum of stockholders is necessary to take action at the Annual Meeting. A majority of the outstanding shares of common stock, present in person or represented by proxy, will constitute a quorum at the Annual Meeting. The inspectors of election appointed for the Annual Meeting will determine whether or not a quorum is present. The inspectors of election will treat abstentions and broker non-votes as present and entitled to vote for purposes of determining the presence of a quorum. A broker non-vote occurs when a Broker holding shares for a beneficial owner does not have discretionary authority to vote the shares and has not received instructions from the beneficial owner as to how the beneficial owner would like the shares to be voted.

PROPOSAL I1 — ELECTION OF DIRECTORS

At the recommendation of the Corporate Governance Committee, the Board has nominated the persons listed below to serve as directors, each for a one-year term, beginning at the Annual Meeting on May 14, 201313, 2014 and running until the 20142015 Annual Meeting. The nominees include ten independent directors, as defined in the applicable rules of the NYSE, and the President and Chief Executive Officer of the Company. The nominees do not include Ian M. Rolland, who is currently serving as Chairman and will retire from the Board at the Annual Meeting when his current term ends. The Board has determined that it will not fill the vacancy of Mr. Rolland; therefore, upon Mr. Rolland’s retirement, the Board will be reduced by one to eleven directors. The Board does not anticipate that any of the nominees will be unable to serve, but if any nominee is unable to serve, the proxies will be voted in accordance with the judgment of the person or persons voting the proxies.

All of the nominees currently serve on the Board.

The following chart gives information about all nominees (each of whom has consented to being named in the proxy statement and to serving if elected). The dates shown for service as a director include service as a director of the Company and its corporate predecessor.

Vote Required

In order to be elected, each nominee must receive more votes cast in favor of his or her election than against election. Abstentions and broker non-votes will not be voted with respect to the election of directors and therefore will have no effect on the vote.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED BELOW.

Name, Age and Principal Occupations for Past Five Years and | Has Been a Director Since | |

Richard A. Abdoo, | 2008 | |

Since May 2004, Mr. Abdoo has been President of R.A. Abdoo & Co. LLC, Milwaukee, Wisconsin, an environmental and energy consulting firm. Prior thereto, Mr. Abdoo was Chairman and Chief Executive Officer of Wisconsin Energy Corporation from 1991 until his retirement in April 2004. He also served as President of Wisconsin Energy Corporation from 1991 to April 2003. Mr. Abdoo is also a director of A.K. Steel Corporation and ZBB Energy Corp. | ||

By virtue of his former positions as Chairman and Chief Executive Officer of a large electric and gas utility holding company, as well as his current positions as director of one other energy-related company and a steel maker that is a major user of energy, Mr. Abdoo has extraordinary expertise and experience with the issues facing the energy industry in general and public utilities in particular. As a former chief executive officer, Mr. Abdoo | ||

Aristides S. Candris, | 2012 | |

Dr. Candris was President and Chief Executive Officer of Westinghouse Electric Company (“Westinghouse”) Pittsburgh, Pennsylvania, a unit of Tokyo-based Toshiba Corp., from July 2008 until his retirement on March 31, 2012. During his 36 years of service at Westinghouse, Dr. Candris served in various positions, including Senior Vice President, Nuclear Fuel from September 2006 to July 2008. Dr. Candris was also on the board of Westinghouse until October 1, 2012 and is a director of Kurion, Inc. | ||

Dr. Candris is a nuclear scientist and engineer, and has significant experience gained through leading a global nuclear power company. His knowledge of the electric industry gives him significant insight on the issues impacting the electric utility industry. His experience managing highly technical engineering operations is valuable as we build and maintain facilities to address increasing environmental regulations and make long-term strategic decisions on electric power generation. His technical and management skills are helpful as we build and modernize both our transmission and distribution systems. Dr. Candris’ experience developing customer focused programs and attaining excellence in business processes and behaviors is insightful as we better meet the increasing expectations of customers and regulators. He serves on the Boards of Carnegie Mellon University and Transylvania University. He also serves on the Board of Directors for the World Nuclear | ||

Name, Age and Principal Occupations for Past Five Years and | Has Been a Director Since | |

Sigmund L. Cornelius, | 2011 | |

Since April 1, 2014, Mr. Cornelius has been President and Chief Operating Officer of Freeport LNG, LLC. From October 2008 | ||

Mr. Cornelius has significant experience in the oil and natural gas industry, which enables him to provide valuable insight on issues impacting our pipeline business. He also has significant experience in exploration, production as well as the midstream business, which is valuable to us as we expand our presence in the Utica and Marcellus Shale gas plays. In addition, as the former Chief Financial Officer of a public company, he has extensive experience and skills in the areas of corporate finance, accounting, strategic planning and risk oversight. | ||

Michael E. Jesanis, | 2008 | |

Since | ||

By virtue of his former positions as President and Chief Executive Officer, Chief Operating Officer and, prior thereto, Chief Financial Officer of a major electric and gas utility holding company, as well as his current role with an energy efficiency consulting firm, Mr. Jesanis has extraordinarily broad and deep experience with regulated utilities. He has strong financial acumen and extensive managerial experience, having led modernization efforts in the areas of operating infrastructure improvements, customer service enhancements and management-team development. Mr. Jesanis also demonstrates a commitment to education as the former chair of the board of a college and a current trustee (and past chair of the audit committee) of a university. As a result of his former senior managerial roles and his non-profit board service, Mr. Jesanis also has particular expertise with board governance issues. | ||

Name, Age and Principal Occupations for Past Five Years and | Has Been a Director Since | |

Marty R. Kittrell, | 2007 | |

In February 2011, Mr. Kittrell retired as Executive Vice President & Chief Financial Officer of Dresser, Inc. | ||

Mr. Kittrell brings to the Board over 25 years of experience as a Chief Financial Officer. He has served in the role of Chief Financial Officer at several public companies. As a result of this experience, he has significant expertise with financial reporting issues facing the Company, including Securities and Exchange Commission reporting, and Sarbanes-Oxley internal control design and implementation. His recent position with a company that supplies infrastructure products to the energy industry gives Mr. Kittrell a particular familiarity with the issues facing the Company’s gas transmission and storage and gas distribution businesses. Mr. Kittrell also has extensive experience with mergers and acquisitions and capital markets transactions. He formerly practiced accounting with a national accounting firm and is an active member of the American Institute of CPAs, the National Association of Corporate Directors, and Financial Executives International. Mr. Kittrell also shows a commitment to education through his service on the board of trustees of a university. | ||

W. Lee Nutter, | 2007 | |

Prior to his retirement in 2007, Mr. Nutter was Chairman, President and Chief Executive Officer of Rayonier, Inc., Jacksonville, Florida, a leading supplier of high performance specialty cellulose fibers and owner of timberlands and other higher value land holdings. Mr. Nutter was a director of Rayonier, Inc. from 1996 to 2009. He is also a director of Republic Services Inc. and the non-executive Chairman of J.M. Huber Corporation. He is also a member of the Advisory Board at the University of Washington Foster School of Business. | ||

Mr. Nutter’s former positions as Chairman and Chief Executive Officer of a forest products company, and his current positions as director of one company engaged in waste management and another involved in the forest products and energy industries, give him a particular familiarity with the issues involved in managing natural resources. These issues include compliance with environmental laws and exercising responsible environmental stewardship. Mr. Nutter also has an extensive background and familiarity in human resource and compensation issues, which complements well his service as chair of the Company’s Officer Nomination and Compensation Committee. In addition, as a former Chief Executive Officer, Mr. Nutter understands how to address the complex issues facing major corporations. | ||

Name, Age and Principal Occupations for Past Five Years and | Has Been a Director Since | |

Deborah S. Parker, | 2007 | |

Ms. Parker joined Alstom Power, a business segment of Alstom, in April 2011 and is currently serving as Senior Vice President, Quality and Environmental, Health and Safety. Alstom Power is a global leader in power generation located in Zurich, Switzerland. From April 2008 until April 2011, Ms. Parker was President and Chief Executive Officer of International Business Solutions, Inc. (“IBS”), Washington, D.C., a provider of strategic planning and consulting services to profit and not-for-profit organizations. Before joining IBS, Ms. Parker was Executive Vice President and Chief Operations Officer of the National Urban League from July 2007 through April 2008. Prior thereto, Ms. Parker served in numerous operating positions, including Vice President of Global Quality at Ford Motor Company. During her tenure at Ford, Ms. Parker also served as Chief Executive Officer and Group Managing Director at Ford Motor Company of Southern Africa (Pty) Ltd. from September 2001 to December 2004. | ||

Ms. Parker brings a unique combination of community development and industrial management experience to the Board. As a Senior Vice President of quality, environmental, health and safety of a global power generation firm, she brings knowledge and understanding of operations, health and safety issues that are valuable to us as we execute on our commitment to increase our investment in environmental projects and focus on safety. As a former Chief Executive Officer of a consulting firm and Chief Operating Officer of a national civil rights organization dedicated to economic empowerment of historically underserved urban communities, Ms. Parker brings expertise and understanding with respect to the social and economic issues confronting the Company and the communities it serves. As a result of her 23-year career at a global manufacturing company, Ms. Parker has extensive experience managing industrial operations, including turning around several struggling business units, finding innovative solutions to management and union issues, implementing quality control initiatives and rationalizing manufacturing and inventory. This experience positions her well to provide valuable insights on the Company’s operations and processes, as well as on social issues confronting the Company. | ||

Robert C. Skaggs, Jr., | 2005 | |

Chief Executive Officer of the Company since July 2005. President of the Company since October 2004. Prior thereto, Mr. Skaggs served as Executive Vice President, Regulated Revenue from October 2003 to October 2004; President of Columbia Gas of Ohio, Inc. from February 1997 to October 2003; President of Columbia Gas of Kentucky, Inc. from January 1997 to October 2003; President of Bay State Gas Company and Northern Utilities from November 2000 to October 2003; and President of Columbia Gas of Virginia, Inc., Columbia Gas of Maryland, Inc. and Columbia Gas of Pennsylvania, Inc. from December 2001 to October 2003. | ||

The Board believes it is important that the Company’s Chief Executive Officer serve on the Board. Mr. Skaggs has a unique understanding of the challenges and issues facing the Company. During his nearly | ||

Name, Age and Principal Occupations for Past Five Years and | Has Been a Director Since | |

Teresa A. Taylor, | 2012 | |

Ms. Taylor is currently Chief Executive Officer of Blue Valley Advisors, LLC. Ms. Taylor served as Chief Operating Officer of Qwest Communications, Inc. | ||

In her position as Chief Operating Officer, Ms. Taylor was responsible for the daily operations of a publicly traded telecommunications company. In this role, she led a senior management team responsible for field support, technical development, sales, marketing, customer support and information technology systems. During her 24-year tenure with Qwest and US West, she held various leadership positions responsible for strategic planning and execution, sales, marketing, product development, human resources, corporate communications and social responsibility. Ms. Taylor is keenly aware of the technical and managerial skills necessary to operate a customer service company in a complex regulatory and competitive business environment. This experience will provide valuable insights to the Company as it operates in multiple regulatory environments and develops products and customer service programs to meet the expectations of our customers. | ||

Richard L. Thompson, | 2004 | |

Independent Chairman of the Board since May 2013. Prior to his retirement in 2004, Mr. Thompson was Group President, Caterpillar Inc., Peoria, Illinois, a leading manufacturer of construction and mining equipment, diesel and natural gas engines and industrial gas turbines. Mr. Thompson also is | ||

In his prior role as Group President of a large, publicly traded manufacturing company, Mr. Thompson had responsibility for its gas turbine and reciprocating engine business, as well as research and development activities. By virtue of this and prior positions, | ||

Name, Age and Principal Occupations for Past Five Years and | Has Been a Director Since | |

Carolyn Y. Woo, | 1998 | |

Since January 2012, Dr. Woo has been President and Chief Executive Officer of Catholic Relief Services, the international humanitarian agency of the Catholic community in the United States. Prior thereto, Dr. Woo was Martin J. Gillen Dean and Ray and Milann Siegfried Professor of Entrepreneurial Studies, Mendoza College of Business, University of Notre Dame, Notre Dame, Indiana. Dr. Woo is also a director of AON Corporation and was a director of Circuit City, Inc. until 2009. | ||

Dr. Woo’s current position as President and Chief Executive Officer of an international organization provides her with knowledge and experience in managing a large organization. Her experience as the dean of a major business school and her experience as a professor of entrepreneurship provided her a deep understanding of business principles and extensive expertise with management and strategic planning issues. Through her current and previous service on the boards of directors, audit committees and compensation committees of a number of public companies, including a global reinsurance and risk management consulting company, a pharmaceutical distribution company, an international automotive manufacturer, a financial institution and a major electronics retailer, Dr. Woo has developed an excellent understanding of corporate governance, internal control, financial and strategic analysis and risk management issues. Dr. Woo is a leader in the areas of corporate social responsibility and sustainability, which adds an important perspective to the Company. She is also a current and past board member of several non-profit organizations, including an international relief organization, a global business school accreditation organization, leadership development organizations and an educational organization. This commitment to social and educational organizations provides Dr. Woo with an additional important perspective on the various community and social issues confronting the Company in the various communities that the Company serves. | ||

Under the NiSource Corporate Governance Guidelines, a substantial majority of our Board must be comprised of “independent directors.” In order to assist the Board in making its determination of director independence, the Board has adopted categorical standards of independence consistent with the standards contained in Section 303A.02(b) of the NYSE Corporate Governance Listing Standards. The Board also has adopted an additional independence standard providing that a director who is an executive officer of a company that has made payments to, or received payments from the Company for property or services within the last three years in excess of 1% of such other company’s consolidated gross revenues is not independent. These categorical standards of independence are listed in the Company’s Corporate Governance Guidelines, a copy of which can be found on our website athttp://ir.nisource.com/governance.cfm.

The Board has affirmatively determined that, with the exception of Mr. Skaggs, all of the members of the Board (except Mr. Skaggs) and all nominees (except Mr. Skaggs) are “independent directors” as defined in Section 303A.02(b) of the NYSE Listing Standards and meet the standardsadditional standard for independence set by the Board.

Policies and Procedures with Respect to Transactions with Related Persons

We have established policies and procedures with respect to the review, approval and ratification of any transactions with related persons as set forth in the Audit Committee Charter and the Code of Business Conduct.

Under its Charter, the Audit Committee is charged with the review of reports and disclosures of insider and affiliated party transactions. Under the Code of Business Conduct, the following situations must be reviewed if they involve a direct or indirect interest of any director, executive officer or employee (including immediate family members):

owning more than a 10% equity interest or a general partner interest in any entity that transacts business with the Company (including lending or leasing transactions, but excluding the receipt of utility service from the Company at tariff rates), if the total amount involved in such transactions may exceed $120,000;

selling anything to the Company or buying anything from the Company (including lending or leasing transactions, but excluding the receipt of utility service from the Company at tariff rates), if the total amount involved in such transactions may exceed $120,000;

consulting for or being employed by a competitor; and

being in the position of supervising, reviewing or having any influence on the job evaluation, pay or benefit of any immediate family member.

Related party transactions requiring review under the Code of Business Conduct are annually reviewed and ratified by the Audit Committee. Directors, individuals subject to Section 16 of the Securities Exchange Act of 1934 (Section 16 Officers) and senior executive officers are expected to raise any potential transactions involving a conflict of interest that relates to them with the Audit Committee so that they may be reviewed in a prompt manner.

Executive Sessions of Non-Management Directors

To promote open discussion among the non-management directors, the Board schedules regular executive sessions at meetings of the Board and each of its Committees. All non-management directors are also members of the Corporate Governance Committee. The non-management members met separately from management five times in 2012. Mr. Ian M. Rolland,2013 in sessions at which the independent Chairman of the Board served as lead, or presiding, director at the executive sessions of the non-management directors.presided. All of the non-management members are “independent directors.”

Communications with the Board and Non-Management Directors

Stockholders and other interested persons may communicate any concerns they may have regarding the Company as follows:

Communications to the Board may be made to the Board generally, any director individually, the non-management directors as a group, or the lead directorChairman of the non-management group in the event one is chosen,Board, by writing to the following address:

NiSource Inc.

Attention: [Board of Directors]/[Board Member]/[Non-management Directors]/[Lead Director]Chairman of the Board]

c/o Corporate Secretary

801 East 86th Avenue

Merrillville, Indiana 46410

| • | The Audit Committee has approved procedures with respect to the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or audit matters. Communications regarding such matters may be made by contacting the Company’s Ethics and Compliance Officer atethics@nisource.com, calling the business ethics hotline at 1-800-457-2814, or writing to: |

NiSource Inc.

Vice President, Ethics and Compliance and Deputy General Counsel

801 East 86th Avenue

Merrillville, Indiana 46410

The Company has adopted a Code of Business Conduct (the “Code”) to promote (i) ethical behavior including the ethical handling of conflicts of interest, (ii) full, fair, accurate, timely and understandable financial disclosure, (iii) compliance with applicable laws, rules and regulations, (iv) accountability for adherence to the Code and (v) prompt internal reporting of violations of the Code. The Code satisfies applicable Securities and Exchange Commission (“SEC”) and NYSE requirements and applies to all directors, officers (including our principal executive officer, principal financial officer, principal accounting officer and controller) as well as employees of the Company and its affiliates. A copy of the Code is available on our website athttp://ir.nisource.com/governance.cfmand will be provided to any stockholder who requests it in writing from the Company’s Corporate Secretary.

Any waiver of the Code for any director, Section 16 Officer or senior executive may be made only by the Audit Committee of the Board and must be promptly disclosed to the extent and in the manner required by the SEC or the NYSE and posted on the Company’s website. No waivers have been granted under the Code.

Corporate Governance Guidelines

The Corporate Governance Committee is responsible for annually reviewing and reassessing the Corporate Governance Guidelines and will submit any recommended changes to the Board for its approval. A copy of the Corporate Governance Guidelines can be found on our website athttp://ir.nisource.com/governance.cfm and will be provided to any stockholder who requests it in writing from the Company’s Corporate Secretary.

Board Leadership Structure and Risk Oversight

The Company’s Corporate Governance Guidelines state that the Company should remain free to configure leadership of the Board in the way that best serves the Company’s interests at the time and, accordingly, the Board has no fixed policy with respect to combining or separating the offices of Chairman and CEO. If the Chairman is not an independent director, the Board will choose a lead director to serve as chair of the Corporate Governance Committee and as the presiding director for purposes of the NYSE rules.

Since late 2006, the offices of Chairman and CEO of the Company have been held by different individuals, with the Chairman being an independent director. In deciding to separate the offices, the Board believed that having a director with a long tenure serve as Chairman would help ensure continuity and stability. The Board believes that the independent Chairman arrangement continues to serve the Company well.

The Board takes an active role in monitoring and assessing the Company’s risks, which include risks associated with operations, credit, energy supply, financing, capital investments, and capital investments.compensation policies and practices. The Board administers its oversight function through utilization of its various committees, as well as through a Risk Management Committee, consisting of members of the Company’s senior management, which is responsible for the risk management process. Senior management provides an annual report on our risks to the Board. The Audit Committee discusses with management and the independent auditor the effect of regulatory and accounting initiatives on the Company’s financial statements and is responsible for overseeing the risk management program generally. The Audit Committee receives regular updates on the activities of the Risk Management Committee and any significant policy breach, if one were to occur. In addition, the Finance Committee, Officer Nomination and Compensation (“ONC”) Committee and the Environmental, Safety and Sustainability (“ESS”) Committee are each charged with overseeing the risks associated with their respective areas of responsibility. The Audit Committee receives regular updates on the activities of the Risk Management Committee and any significant policy breach, if one were to occur.

Meetings and Committees of the Board

The Board met five times during 2012.2013. Each director attended at least 81%80% of the total number of the Company’s Board meetings and the meetings of the committees of which he or she was a member. Pursuant to the Company’s Corporate Governance Guidelines, all directors are expected to attend the Annual Meeting. All incumbent directors attended the 20122013 Annual Meeting of Stockholders with the exception of Dr. Woo.Ms. Deborah S. Parker.

The Board has established five standing committees to assist the Board in carrying out its duties: the Audit Committee;Committee, the Corporate Governance Committee;Committee, the ESS Committee;Committee, the Finance Committee;Committee, and the ONC Committee. The Board also appointed two special committees, the Pricing Committee and the Search Committee, in carrying out its duties in 2012. The Board evaluates the structure and membership of its committees on an annual basis and appoints the independent members of the Board to serve on the committees and elects committee chairs following the Annual Meeting of Stockholders. The following tables show the composition of each Board committee before and after the 20122013 Annual Meeting. Mr. Skaggs does not serve on any committee but is invited to attend the various committee meetings. Mr. Thompson, who was elected Chairman of the Board in May 2013, also serves as the Chair of the Corporate Governance Committee and is invited to attend all meetings of each of the standing committees.

Board Committee Composition — May 10, 201115, 2012 through May 15, 2012

| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

| ||||||||||||||||||||

Board Committee Composition — Beginning May 15, 20122013

| Director | Audit | Corporate Governance | ESS | Finance | ONC | |||||||||||||||

Richard A. Abdoo | X | X | * | X | ||||||||||||||||

Aristides S. Candris | X | X | X | |||||||||||||||||

Sigmund L. Cornelius | X | X | X | |||||||||||||||||

Michael E. Jesanis | X | X | X | * | ||||||||||||||||

Marty R. Kittrell | X | *(F) | X | X | ||||||||||||||||

W. Lee Nutter | X | X | X | * | ||||||||||||||||

Deborah S. Parker | X | X | X | |||||||||||||||||

Ian M. Rolland(1) | X | X | * | X | ||||||||||||||||

Teresa A. Taylor | X | X | X | |||||||||||||||||

Richard L. Thompson | X | X | X | |||||||||||||||||

Carolyn Y. Woo | X | X | X | |||||||||||||||||

| * |

| (1) | Independent Chairman of the Board. Mr. Rolland retired from the Board on May 14, 2013. |

| (F) | Audit Committee Financial Expert, as defined by the SEC rules. |

Board Committee

The Audit Committee met ten times in 2012. Among other things, the Audit Committee is responsible for monitoring: Composition — Beginning May 15, 2013

integrity of the Company’s financial statements;

| Director | Audit | Corporate Governance | ESS | Finance | ONC | |||||||||||||||

Richard A. Abdoo | X | X | * | X | ||||||||||||||||

Aristides S. Candris | X | X | X | |||||||||||||||||

Sigmund L. Cornelius | X | X | X | |||||||||||||||||

Michael E. Jesanis | X | X | * | X | ||||||||||||||||

Marty R. Kittrell | X | *(F) | X | X | ||||||||||||||||

W. Lee Nutter | X | X | X | * | ||||||||||||||||

Deborah S. Parker | X | X | X | |||||||||||||||||

Teresa A. Taylor | X | X | X | |||||||||||||||||

Richard L. Thompson(1) | X | * | ||||||||||||||||||

Carolyn Y. Woo | X | X | X | |||||||||||||||||

the independent auditors’ qualifications and independence;

performance of the Company’s internal audit function and the independent auditors; and

| * | Committee Chair |

| (1) | Independent Chairman of the Board |

compliance by the Company with legal and regulatory requirements.

| (F) | Audit Committee Financial Expert, as defined by the SEC rules. |

The charter for each of the Audit, CommitteeCorporate Governance, ESS, Finance and ONC Committees can be found on our website athttp://ir.nisource.com/governance.cfmand will be provided to any stockholder who requests it in writing from the Company’s Corporate Secretary.

Audit Committee

The Audit Committee met eight times in 2013. Among other things, the Audit Committee has the sole authority to appoint, retain or replace the independent auditors and is responsible for overseeing:

the integrity of the Company’s financial statements;

the independent auditors’ qualifications and independence;

the performance of the Company’s internal audit function and the independent auditors;

the review of related party transactions; and

the compliance by the Company with legal and regulatory requirements.

The Board has determined that all of the members of the Audit Committee are independent as defined under the applicable NYSE and SEC rules, including the additional independence standard for audit committee members, and meet the additional independence standard set forth in the Corporate Governance Guidelines. The Audit Committee has reviewed and approved the independent registered public accountants, both for 20122013 and 2013,2014, and the fees relating to audit services and other services performed by them.

For more information regarding the Audit Committee, please see “Audit Committee Report” below.

Corporate Governance Committee

The Corporate Governance Committee met fivesix times in 2012.2013. The Committee is responsible for:

recommending to the Board the compensation of directors;

identifying individuals qualified to become Board members, consistent with criteria approved by the Board;

recommending to the Board director nominees for election at the next Annual Meeting of the stockholders;

developing and recommending to the Board a set of corporate governance principles applicable to the Company; and

overseeing the evaluation of the performance of the Board, the CEO and the CEO’s executive direct reports.

Pursuant to the Corporate Governance Guidelines, the Committee, with the assistance of the ONC Committee and its independent compensation consultant, reviews the amount and composition of director compensation from time to time and makes recommendations to the Board when it concludes changes are needed. The Committee is also responsible for evaluating the performance of the CEO and his executive direct reports. The Committee reviews and approves the Company’s goals and objectives relevant to the CEO and his executive direct reports and evaluates their performance in light of those goals and objectives and after receiving input from the Board. The Chair of the Committee reports the Committee’s findings to the ONC Committee, which uses these findings to set the compensation of the CEO and his executive direct reports.

The Committee identifies and screens candidates for director and makes its recommendations for director to the Board as a whole. The Committee has the authority to retain a search firm to help it identify director candidates to the extent it deems necessary or appropriate. The Committee appointed a sub-committee of directors (the “Search Committee”) to assist with the evaluation of the candidates identified by Russell Reynolds Associates Inc., a third party search firm engaged by the Committee, in conjunction with identification of candidates for election in 2012. During 2012, Messrs. Jesanis, Kittrell and Rolland and Ms. Parker served for a portion of the year on the Search Committee which met two times during 2012. The Search Committee did not meet to consider any candidates for election in 2013.

In considering candidates for director, the Committee considers the nature of the expertise and experience required for the performance of the duties of a director of a company engaged in our businesses, as well as each candidate’s relevant business, academic and industry experience, professional background, age, current employment, community service, other board service and other board service.factors. Pursuant to the Corporate Governance Guidelines, the Committee also considers the racial, ethnic and gender diversity of the Board. The Committee seeks to identify and recommend candidates with a reputation for and record of integrity and good business judgment who: have experience in positions with a high degree of responsibility and are leaders in the organizations with which they are affiliated, are effective in working in complex collegial settings, are free from conflicts of interest that could interfere with a director’s duties to the Company and its stockholders and are willing and able to make the necessary commitment of time and attention required for effective service on the Board. The Committee also takes into account the candidate’s level of financial literacy. The Committee monitors the mix of skills and experience of the directors in order to assess whether the Board has the necessary tools to perform its oversight function effectively. The Committee also assesses the diversity of the Board as part of its annual self-assessment process. The Committee will consider nominees for directors recommended by stockholders and will use the same criteria to evaluate candidates proposed by stockholders.

The Board has determined that all of the members of the Committee are independent as defined under the applicable NYSE rules and meet the additional independence standard set forth in the Corporate Governance Guidelines.

The charter for the Committee can be found on our website athttp://ir.nisource.com/governance.cfmand will be provided by the Company to any stockholder who requests it in writing from the Company’s Corporate Secretary.

For information on how to nominate a person for election as a director at the 20142015 Annual Meeting, please see the discussion under the heading “Stockholder Proposals and Nominations for 20142015 Annual Meeting.”

Environmental, Safety and& Sustainability Committee

The ESS Committee met sixfive times during 2012. This2013. The Committee reviewsassists the results ofBoard in overseeing the programs, performance and risks relative to environmental, compliance ofsafety and sustainability matters. In this regard, the Company and considers environmental public policy issues as well as health and safety issues affecting the Company. The charter for the Committee can be found on our website athttp://ir.nisource.com/governance.cfmand will be provided to any stockholder who requests it in writing fromCommittee:

evaluates the Company’s Corporate Secretary.environmental and sustainability policies and practices;

evaluates the Company’s safety policies and practices relating to the Company’s employees and contractors and the general public; and

assesses major legislation, regulation and other external influences that pertain to the Committee’s responsibilities.

Finance Committee

The Finance Committee met fivesix times during 2012.2013. This Committee is responsible for overseeing and monitoring monitoring:

the financial plans of the Company, capital structure, investment strategy, capital budgets and financial risk. The charter for the Committee can be found on our website athttp://ir.nisource.com/governance.cfmand will be provided to any stockholder who requests it in writing from risks;

the Company’s Corporate Secretary.dividend policy and periodic dividends;

the Company’s corporate insurance coverage; and

the Company’s hedging policies and exempt swap transactions.

Officer Nomination and Compensation Committee

The ONC Committee met sixseven times in 2012.2013. The charter for the Committee can be found on our website athttp://ir.nisource.com/governance.cfmand will be provided to any stockholder who requests it in writing from the Company’s Corporate Secretary. Pursuant to the charter, this Committee advises the Board with respect to nomination, evaluation, compensation and benefits of the Company’s executives. In that regard, the Committee:

approves the CEO’s compensation based on the Corporate Governance Committee’s report on itsthe evaluation of the CEO’s performance;

approves the compensation of the CEO’s executive direct reports;

makes recommendations to the Board with respect to incentive-compensationincentive compensation plans and equity-based plans;

reviews and approves periodically a general compensation policy for other officers of the Company and officers of its principal affiliates;subsidiaries;

recommends Company officer candidates for election by the Board;Board, and oversees the evaluation of management;

evaluates the risks associated with the Company’s compensation policies and practices; and

oversees the evaluation of management;equal employment opportunity and diversity initiatives.

produces the ONC Committee Report on Executive Compensation included in this proxy statement.

The ONC Committee reviews the compensation of our CEO and his executive direct reports each year. In determiningapproving the compensation of the CEO and his executive direct reports, the Committee takes into consideration the Corporate Governance Committee’s evaluation of each of their individual performance. When considering changes in compensation for the Named Executive Officers, the Committee also carefully considers input from the Senior Vice President, Human Resources and Exequity LLP, an executive compensation consulting firm that the Committee engaged to advise it with respect to executive compensation design, comparative compensation practices and compensation matters relating to the Board. Exequity LLP provides no other services to the Company. The ONC Committee has determined Exequity LLP is independent under the NYSE rules.

All of the directors serving on the Committee are (i) independent as defined under the applicable NYSE and SEC rules and meet the additional independence standard set forth in the Corporate Governance Guidelines and the additional NYSE standard for compensation committees, that takes effect later this year, (ii) “non-employee directors” as defined under Rule 16b-3 of the Securities Exchange Act of 1934 (“Exchange Act”), and (iii) “outside directors” as defined by Section 162(m) of the Internal Revenue Code.

Pricing Committee

The Pricing Committee was appointed as a special committee in 2012 to review and approve the issuance of debt in 2012. Messrs. Kittrell, Rolland and Thompson served on this Committee which met one time in 2012.

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2013, Messrs. Abdoo, Cornelius, Jesanis and Nutter, Ms. Taylor and Dr. Woo served on the ONC Committee. There arewere no compensation committee interlocks.interlocks or insider participation.

Director Compensation. We use a combination of cash and stock-based awards to attract and retain highly qualified candidates to serve on the Board. Only non-employee directors receive director compensation. Therefore, since Mr. Skaggs is an employee of the Company, he does not receive compensation for his service as a Board member.

We currently pay each director who is not an employee of the Company an annual retainer of $190,000, consisting of $82,500 in cash and an award of restricted stock units valued at $107,500 at the time of the award. The cash retainer is paid in arrears in four equal installments at the end of each calendar quarter.

The restricted stock units are awarded annually and the number of restricted stock units is determined by dividing the value of the grant by the closing price of the Company’s common stock on the date of grant. Restricted stock units are granted to directors under the NiSource Inc. 2010 Omnibus Incentive Plan (“Omnibus Plan”), which was approved by the stockholders in May 2010.

The Board also provides additional compensation to those directors who take on additional responsibilities and serve as the chair of a Board committee. The annual committee chair fees are: Audit Committee $20,000; ONC Committee $20,000; Finance Committeeare $20,000 and ESS Committee $15,000.for each of the standing committees. The Chairman of the Board who also serves as the chair of the Corporate Governance Committee, receives additional annual compensation of $135,000 per year. Fees paid to the Chairman of the Board and the committee chairs$160,000. These fees are paid in cash in arrears in four equal installments, in arrears. Feesand are prorated based on when Board and committee service begins or ends.in the case of partial year service.

All Other Compensation. The only other compensation reportable under the column “All Other Compensation” in the Director Compensation table below is matching contributions made by the NiSource Charitable Foundation.

Omnibus Plan.Plan. The Omnibus Plan permits equity awards to be made to non-employee directors in the form of incentive and non-qualified stock options, stock appreciation rights, restricted stock and restricted stock units, performance shares, performance units, cash-based awards and other stock-based awards. Terms and conditions of awards to non-employee directors are determined by the Board prior to grant. Since May 10, 2010, awards to directors have been made from the Omnibus Plan. Awards of restricted stock units associated with periods prior to June 1, 2011, vested immediately but are not distributed in shares of common stock until after the director terminates or retires from the Board. As of June 1, 2011, the awards of restricted stock units vest and are payable in shares of common stock on the earlier of (a) the last day of the director’s annual term for which the restricted stock units are awarded or (b) the date that the director separates from service due to a “Change in Control” (as defined in the Omnibus Plan); provided, however, that in the event that the director separates from service prior to such time as a result of “Retirement” (defined as the cessation of services after providing a minimum of five continuous years of service as a member of the Board), death or “Disability” (as defined in the Omnibus Plan), the director’s restricted stock unit awards shall pro-rata vest in an amount determined by using a fraction, where the numerator shall be the number of full or partial calendar months elapsed between the grant date and the date of the director’s Retirement, death or Disability, and the denominator of which shall be the number of full or partial calendar months elapsed between the grant date and the last day of the director’s annual term for which the director is elected that corresponds to the year in which the restricted stock units are awarded. The vested restricted stock units awarded as of June 1, 2011 are payable as soon as practicable following vesting except as otherwise provided pursuant to the non-employee director’s prior election to defer distribution.

With respect to restricted stock units that have not been distributed, additional restricted stock units are credited to each non-employee director to reflect dividends paid to stockholders on common stock. The restricted stock units have no voting or other stock ownership rights and are payable in shares of the Company’s common stock upon distribution.

Director Stock Ownership. The Board maintains stock ownership requirements for its directors that are included in the Corporate Governance Guidelines. Within five years of becoming a non-employee director or adoption of these ownership requirements in 2008, whichever is later, each non-employee director is required to hold an amount of Company stock with a value equal to five times the annual cash retainer paid to directors by the Company. Company stock that counts towards satisfaction of this requirement includes shares purchased on the open market, awards of restricted stock or restricted stock units through the prior Non-Employee Director Stock Incentive Plan or Omnibus Plan, and shares beneficially owned in a trust or by a spouse or other immediate family member residing in the same household.

Each director has a significant portion of his or her compensation directly aligned with long-term stockholder value. Fifty-sixFifty-seven percent (56%(57%) of the Board’s annual retainer is awarded in restricted stock units, which are converted into common stock when distributed to the director. The directors are also required to accumulate and hold five times their annual cash retainer in our common stock which is designed to align their compensation with long-term shareholder value.

The table below shows the number of shares of common stock beneficially owned by each non-employee director, the number of non-voting restricted stock units that have been awarded, and the combined total as of February 28, 2013.2014.

| Name | Shares of Common Stock | Non-Voting Stock Units(1) | Total Number of Non-Voting Units(1) | Shares of Common Stock | Non-Voting Stock Units(1) | Total Number of Non-Voting Units(1) | ||||||||||||||||||

Richard A. Abdoo | 15,000 | 29,125 | 44,125 | 15,000 | 33,837 | 48,837 | ||||||||||||||||||

Aristides S. Candris | 2,000 | 4,408 | 6,408 | 2,000 | 8,332 | 10,332 | ||||||||||||||||||

Sigmund L. Cornelius | 3,235 | 4,408 | 7,643 | 4,235 | 8,332 | 12,567 | ||||||||||||||||||

Michael E. Jesanis | 4,062 | 24,946 | 29,008 | 5,656 | 24,975 | 30,631 | ||||||||||||||||||

Marty R. Kittrell | 6,062 | 30,788 | 36,850 | 1,036 | 31,004 | 32,040 | ||||||||||||||||||

W. Lee Nutter | 114,062 | 30,788 | 144,850 | 114,970 | 35,553 | 150,523 | ||||||||||||||||||

Deborah S. Parker | — | 34,101 | 34,101 | — | 38,972 | 38,972 | ||||||||||||||||||

Ian M. Rolland(2) | 26,777 | 66,791 | 93,568 | |||||||||||||||||||||

Teresa A. Taylor | — | 4,408 | 4,408 | 4,444 | 3,783 | 8,227 | ||||||||||||||||||

Richard L. Thompson | 9,062 | 44,658 | 53,720 | 9,062 | 49,574 | 58,636 | ||||||||||||||||||

Carolyn Y. Woo | 8,062 | 56,726 | 64,788 | 12,506 | 57,770 | 70,276 | ||||||||||||||||||

| (1) | The number includes non-voting restricted stock units |

The table below sets forth all compensation earned by or paid to our non-employee directors in 2012.2013. Mr. Skaggs is the Company’s only employee director and does not receive any separate compensation for his service on the Board.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Total ($) | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | All Other Compensation ($)(3) | Total ($) | |||||||||||||||||||||

Richard A. Abdoo | 95,027 | 107,500 | 202,527 | 102,500 | 107,500 | — | 210,000 | |||||||||||||||||||||

Steven C. Beering(3) | 30,827 | — | 30,827 | |||||||||||||||||||||||||

Aristides S. Candris(4) | 51,895 | 107,500 | 159,395 | |||||||||||||||||||||||||

Aristides S. Candris | 82,500 | 107,500 | — | 190,000 | ||||||||||||||||||||||||

Sigmund L. Cornelius | 82,500 | 107,500 | 190,000 | 82,500 | 107,500 | 10,000 | 200,000 | |||||||||||||||||||||

Michael E. Jesanis | 91,895 | 107,500 | 199,395 | 100,645 | 107,500 | 10,000 | 218,145 | |||||||||||||||||||||

Marty R. Kittrell | 102,500 | 107,500 | 210,000 | 102,500 | 107,500 | — | 210,000 | |||||||||||||||||||||

W. Lee Nutter | 102,500 | 107,500 | 210,000 | 102,500 | 107,500 | — | 210,000 | |||||||||||||||||||||

Deborah S. Parker | 82,500 | 107,500 | 190,000 | 82,500 | 107,500 | — | 190,000 | |||||||||||||||||||||

Ian M. Rolland | 217,500 | 107,500 | 325,000 | |||||||||||||||||||||||||

Teresa A. Taylor(4) | 51,895 | 107,500 | 159,395 | |||||||||||||||||||||||||

Richard L. Thompson | 89,973 | 107,500 | 197,473 | |||||||||||||||||||||||||

Ian M. Rolland(4) | 80,686 | — | — | 80,686 | ||||||||||||||||||||||||

Teresa A. Taylor | 82,500 | 107,500 | — | 190,000 | ||||||||||||||||||||||||

Richard L. Thompson(5) | 195,726 | 107,500 | — | 303,226 | ||||||||||||||||||||||||

Carolyn Y. Woo | 88,105 | 107,500 | 195,605 | 82,500 | 107,500 | 10,000 | 200,000 | |||||||||||||||||||||

| (1) | The fees shown include the annual cash retainer |

| (2) | This column shows the aggregate grant date fair value, computed in accordance with FASB ASC Topic 718, of the restricted stock units granted in |

| (3) |

| (4) | Mr. Rolland retired from the Board on May |

BENEFICIAL OWNERS AND MANAGEMENT

The following table contains information about those persons or groups that are known to the Company to be the beneficial owners of more than five percent of the outstanding common stock.stock, based solely on the latest Schedules 13G and any amendments thereto filed with the SEC on or before February 28, 2014.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class Outstanding | Amount and Nature of Beneficial Ownership | Percent of Class Outstanding | ||||||||||||

T. Rowe Price Associates, Inc.(1) | 19,357,283 | 6.2 | % | |||||||||||||

T. Rowe Price Associates, Inc.(1) | 24,634,963 | 7.8 | % | |||||||||||||

100 East Pratt Street Baltimore, MD 21202 | ||||||||||||||||

BlackRock, Inc.(2) | 18,243,837 | 5.9 | % | |||||||||||||

The Vanguard Group(2) | 21,637,276 | 6.9 | % | |||||||||||||

100 Vanguard Blvd. Malvern, PA 19355 | ||||||||||||||||

BlackRock, Inc.(3) | 19,149,472 | 6.1 | % | |||||||||||||

40 East 52nd Street New York, NY 10022 | ||||||||||||||||

The Vanguard Group, Inc.(3) | 18,134,255 | 5.9 | % | |||||||||||||

100 Vanguard Blvd. Malvern, PA 19355 | ||||||||||||||||

JPMorgan Chase & Co.(4) | 17,240,348 | 5.5 | % | |||||||||||||

JPMorgan Chase & Co.(4) | 19,186,709 | 6.1 | % | |||||||||||||

270 Park Avenue New York, NY 10017 | ||||||||||||||||

State Street Corporation(5) | 15,598,293 | 5.0 | % | |||||||||||||

One Lincoln Street Boston, MA 02111 | ||||||||||||||||

| (1) | As reported on an amendment to statement on Schedule 13G filed with the SEC on behalf of T. Rowe Price Associates, Inc. on February |

| (2) | As reported on an amendment to statement on Schedule 13G filed with the SEC on behalf of |

| (3) | As reported on |

| (4) | As reported on |

The following table contains information about the beneficial ownership of the Company’s common stock as of February 28, 20132014 for each of the directors, nominees and Named Executive Officers, and for all directors and executive officers as a group. Beneficial ownership reflects sole voting and sole investment power, unless otherwise noted.

| Name of Beneficial Owner | Amount and Nature of Beneficial | |||

Richard A. Abdoo | 15,000 | |||

Aristides S. Candris | 2,000 | |||

Sigmund L. Cornelius | ||||

| ||||

| ||||

Michael E. Jesanis | ||||

Glen L. Kettering | 83,534 | |||

Marty R. Kittrell | ||||

W. Lee Nutter | ||||

Deborah S. Parker | — | |||

| ||||

| ||||

Stephen P. Smith | ||||

Jimmy D. Staton | ||||

Teresa A. Taylor | ||||

Richard L. Thompson | 9,062 | |||

Carolyn Y. Woo | ||||

All directors and executive officers as a group | ||||

| (1) | The number of shares owned includes shares held in the Company’s Dividend Reinvestment and Stock Purchase Plan, shares held in the 401(k) Plan, shares held in our Employee Stock Purchase Plan, and restricted shares awarded under the 1994 Long-Term Incentive Plan, Non-Employee Director Stock Incentive Plan and Omnibus Plan. The percentages of common stock owned by any director or Named Executive Officer, or all directors and executive officers as a group, does not exceed one percent of the common stock outstanding as of February 28, |

| (2) | The number of shares |

| (3) |

| The number of shares reported for Mr. Skaggs includes shares owned by the |

COMPENSATION DISCUSSION AND ANALYSIS (CD&A)

The Company had another year of significant achievements in 2013 including:

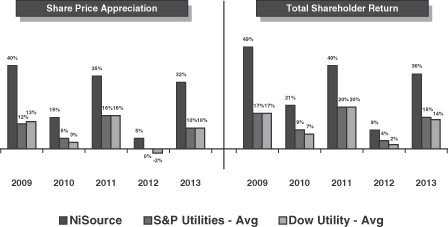

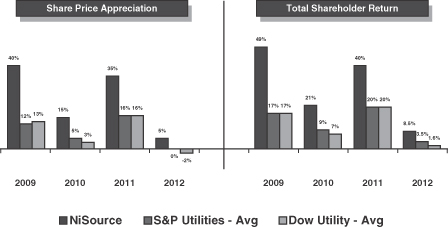

Another industry leading year in stock price appreciation;

Delivering total shareholder return of approximately 36%;

Increasing our annual dividend by approximately 4%;

Outperforming the major utility indices for the fifth consecutive year; and

Generating earnings growth in line with our guidance range for the seventh consecutive year.

Our 2013 performance was once again driven in large part by our continued disciplined execution across all facets of our established infrastructure investment-driven business strategy. Key business accomplishments during 2013 include:

Initiating an industry-leading $4 billion pipeline modernization program;

Replacing 360 miles of distribution pipelines and related facilities;

Completing the first of several electric generation environmental upgrades; and

Being selected as one of the World’s Most Ethical Companies for the third consecutive year.

In addition, we continued to strengthen our financial profile with our capital investment program reaching just over $2 billion dollars while maintaining investment grade credit, and providing a solid and growing dividend.

The ONC Committee considered these achievements while performing its oversight activities throughout the course of the year.

2013 Executive Compensation Highlights

The ONC Committee made a number of compensation decisions during 2013 including:

Approved revised Change-in-Control Agreements for the CEO and other senior executives eliminating grandfathered excise tax gross-up provisions for all of our senior executives other than Mr. Staton, whose Change-in-Control Agreement expired automatically in accordance with its terms when he left the Company on March 31, 2014;

Delivered the 2013 annual long-term equity awards to our Named Executive Officers solely in the form of performance shares that vest only upon the achievement of performance goals and continuous employment over the course of the multi-year performance period;

Awarded Mr. Kettering a special one-time cash bonus of $500,000 in recognition of his strategic leadership in the Federal Energy Regulatory Commission (“FERC”) modernization settlement; and

Determined to leave Named Executive Officers’ 2013 base salaries, and short and long term incentive targets unchanged from the previous year.

Overview of our 2012Our 2013 Executive Compensation Program

Compensation Practices

The primary objectives of our compensation program are to attract, retain and motivate highly qualified executives.

The principal elements of compensation we provide to our executives are: base salary, annual short-term performance-based cash incentives and long-term performance-based equity incentive awards (taken together these three elements are referred to as “total compensation”).

We generally target total compensation to be competitive with the compensation of executives at companies within our peer group of companies (the “Comparative Group”) having similar roles and responsibilities. We do not, however, attempt to maintain a certain target percentile within companies in the Comparative Group.

We use short and long-term performance-based compensation to incentmotivate our executives to meet and exceed the short and long-term business objectives of the Company.

We use 100% performance-based equity compensation for our annual long-term equity incentive awards as a means to align the interests of our executives with those of our stockholders. We also occasionally use special awards of time-vested restricted stock and restricted stock units to attract and retain executive talent, promote management continuity and reward outstanding performance.

We employ leading governance practices, such as clawback policies and stock ownership guidelines, and we conduct an annual risk assessment of the Company’s compensation practices.

In addition, our executive officers are permitted to trade shares only within limited quarterly trading windows, and they are prohibited from engaging in hedging or short sales of the Company’s equity securities.

Finally, when making decisions about our executive compensation program, we take into account the stockholders’ view of such matters. In 2012, 94%2013, 96% of our investors voted in favor of our Say on Pay Proposal at our Annual Meeting. No changes were made to our executive compensation program as a result of the stockholder vote.

Company Performance

2012 was another year of significant achievement for the Company. We experienced another industry leading year in stock price appreciation and total shareholder return. We delivered total shareholder return of approximately 8.5% in 2012, including a dividend increase of more than 4%, outperforming the major utility indices for the fourth consecutive year. Additionally, we generated earnings growth in line with our guidance range for the sixth consecutive year.

Our 2012 performance was driven in large part by our continued disciplined execution across all facets of our established infrastructure investment-driven business strategy. Key business accomplishments during 2012

include reaching a landmark agreement with customers to modernize the Columbia Pipeline Group’s (formerly NiSource Gas Transmission and Storage) Columbia Gas Transmission pipeline system and adding veteran energy industry executives, Joe Hamrock and Jim Stanley, to further strengthen our senior management team. Additionally, we continued to strengthen our financial profile with the issuance of $750 million in long-term debt at historically low rates, and we successfully executed our forward equity issuance of $340 million.

2012Our Executive Compensation HighlightsPhilosophy

The discussion of executive compensation philosophy, program and practices that follows in the balance of the report applies to our Company’s Named Executive Officers in 20122013. They were: Robert C. Skaggs, Jr., President and Chief Executive Officer (“CEO”); Stephen P. Smith, Executive Vice President and Chief Financial Officer; Jimmy D. Staton, former Executive Vice President and Group Chief Executive Officer, Columbia Pipeline Group;Group (“CPG”); Carrie J. Hightman, Executive Vice President and Chief Legal Officer; and Joseph Hamrock, who joinedGlen L. Kettering, Senior Vice President, Corporate Affairs. Mr. Staton stepped down as an executive officer of the Company effective December 31, 2013 and left the Company on March 31, 2014. In 2014 and 2015, Mr. Staton will receive payments in May 2012 as Executive Vice Presidentexchange for a general release and Group Chief Executive Officer of NiSource Gas Distribution.

The ONC Committee made a number of noteworthy compensation decisions during 2012, includingnon-competition agreement pursuant to the following:

The 2012 annual long-term equity awards to our Named Executive Officers were delivered solely in the form of performance shares that vest only upon the achievement of performance goals and continuous employment over the course of the multi-year performance period;

Beginning in 2012, we eliminated total debt as a performance measure for both our annual short-term performance-based incentive program and long-term performance-based equity incentive program;

We added “Relative Total Shareholder Return” as a performance measure for our 2012 performance-based equity awards to our Named Executive Officers as described more fully in the section entitled “LTIP Awards;”

The ONC Committee granted special time-vested equity awards to Messrs. Staton and Hamrock primarily to reward Mr. Staton’s exceptional performance and compensate Mr. Hamrock for the forfeitureterms of his equity awards at his prior employer;

Named Executive Officer base salaries in 2012 remained unchanged from the previous year, with the exception of Messrs. Staton and Smith, as described more fully in the section entitled “2012 Base Salaries;”

In light of serious operating incidents at Springfield, Massachusetts and Sissonville, West Virginia, the CEO recommended that the ONC Committee make discretionary negative adjustments to the annual performance-based cash incentive payouts for each of the Named Executive Officers, other than Mr. Hamrock who did not receive a performance-based cash incentive payout. After careful deliberation, the ONC Committee reduced the CEO’s annual performance-based cash incentive payout by 40 percentage points and reduced the annual performance-based cash incentive for each of the other Named Executive Officers by 10 percentage points.

Our Executive Compensation Philosophyseparation agreement.

The ONC Committee oversees the design, implementation and operation of the Company’s executive compensation programs.program. It is composed entirely of independent directors to ensure that it can performand performs its oversight activities effectively and in compliance with prevailing governance standards. For a description of the ONC Committee’s composition and responsibilities, see the section entitled “Corporate Governance -— Meetings and Committees of the Board” and for a description of the role of itsthe ONC Committee’s independent consultant, see the section entitled “Corporate Governance -— Officer Nomination and Compensation Committee.”

The ONC Committee and management believe that compensation is an important tool to recruit, retain and motivate employees. The key design priorities of the Company’s executive compensation program are to:

(1) Provide a total compensation package that is appropriately competitive within our industry and supports our short-term and long-term business objectives to build stockholder value and sustainable earnings growth by:

attracting and retaining executives through meaningful compensation opportunities;

motivating and rewarding key executives for achieving and exceeding our business objectives; and

providing substantial portions of pay at risk for failure to achieve our business objectives.

(2) Maintain a financially responsible program aligned with the Company’s strategic plan to build stockholder value and long-term, sustainable earnings growth;

(3)

Provide a total compensation package that is appropriately competitive within our industry thereby enhancing the Company’s ability to:

Attract and retain executives through meaningful compensation opportunities;

Motivate and reward key executives for achieving and exceeding our business objectives; and

Provide substantial portions of pay at risk for failure to achieve our business objectives;

Align the interests of stockholders, the Company and executives by placing particular emphasisemphasizing stock-denominated compensation opportunities that are contingent on performance-based equity compensation;goal achievement; and

(4) Establish and maintain our program in accordance

Comply with all applicable laws and regulations.

The ONC Committee believes that ourthe Company’s executive compensation program has been,is thoughtfully and will continueeffectively constructed to be, successful in providing competitive compensation opportunities appropriate to attractfulfill our objectives, incorporates the best features of modern and retain highly qualified executives, while at the same time encouraging our senior executives to strive toward the creation of additionalcontemporary pay systems, and rewards decision making that creates value for our stockholders, as well as our customers and other key stakeholders.

Principal Elements of Our Compensation Program

We have designed our program to meet our objectives using various executive compensation elements that drive both short-term and long-term performance. The principal elements of our executive compensation program are base salary, an annual performance-based cash incentive and long-term performance-based equity incentive opportunities (taken together these are referredwhich we collectively refer to as “total compensation”).

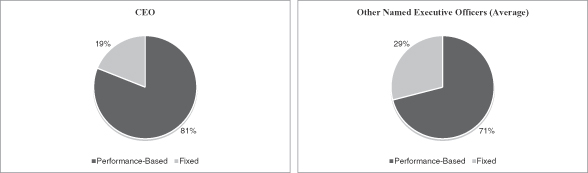

We believe that total compensation for our Named Executive Officers should be largely performance-based and the proportion of at-risk, performance-based compensation should increase as the executive’s level of responsibility within the Company increases. The ONC Committee ensuresbelieves the appropriate mix of the elements of compensation is appropriate by takingshould take into account the Company’s business objectives, the competitive environment, Company performance, individual performance and responsibilities, and evolving governance practices.

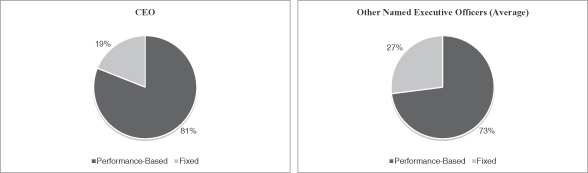

For 2012,2013, the approximate percentage of our Named Executive Officers’ 20122013 total target compensation (base salary, the annual performance-based cash incentive payable at the target level and the grant date face value of the annual long-term performance-based equity incentive award payable at the target level) that was fixed (base salary) was as follows:

The principal elements of our total compensation package, as more fully described below, help us achieve the objectives of our compensation program as follows:

| Time Horizon | ||||||||||||||